In an era where digital payment methods and online transactions have taken center stage, the traditional business check may seem like a relic of the past. However, the importance of business checks in maintaining a professional image for your company cannot be overstated. They offer a multitude of advantages that can enhance your company’s reputation, credibility, and trustworthiness. In this article, we’ll explore the top 8 ways in which using these checks can significantly improve your company’s professional image.

1. Credibility and Trust Building

Establishing credibility and trust is paramount to building strong relationships with clients, partners, and vendors. Utilizing these checks for your financial transactions sends a clear message that your company is legitimate and financially stable. When you pay suppliers or employees with these checks, it demonstrates that you are committed to ethical financial practices, fostering trust and credibility within your industry.

In an age where online scams and fraud are prevalent, the use of business checks provides an additional layer of security. The physical nature of a check adds an element of trust, as it’s not as susceptible to cyberattacks or unauthorized access as digital payments. This sense of security goes a long way toward making your business stand out as a reliable and trustworthy entity.

2. Brand Visibility and Recognition

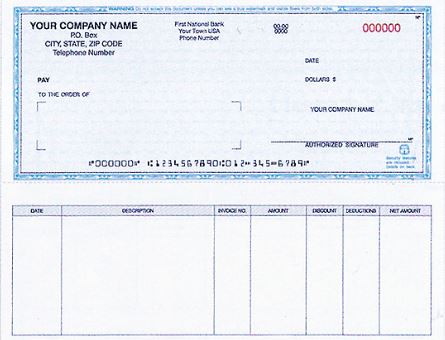

The prominence of your brand and its recognition play a crucial role in your overall professional image. When you employ business checks, you have the opportunity to incorporate your company’s logo and branding elements. This not only reinforces your brand’s identity but also makes your checks instantly recognizable. It’s a subtle yet effective way to promote your brand and create a lasting impression in the minds of those who handle your checks.

The consistent presence of your logo on these checks reinforces brand identity and strengthens brand recognition. This not only conveys professionalism but also reinforces your company’s commitment to its brand, adding to its credibility.

3. Enhanced Financial Accountability

Proper financial management is a hallmark of professionalism. It provides a tangible paper trail for your financial transactions, making it easier to track and monitor your expenses, income, and taxes. This level of financial accountability demonstrates your commitment to responsible financial management, which is highly regarded in the business world.

With digital transactions, it can sometimes be challenging to keep a clear record of your financial activities. It provides a straightforward and organized method for tracking your financial transactions, allowing for better financial planning and decision-making. This ability to manage your finances professionally can significantly improve your image in the eyes of stakeholders and partners.

4. Customization and Personalization

One of the significant advantages of using business checks is the level of customization they offer. You can tailor your checks to meet your company’s unique needs, including selecting the check format, design, and layout that align perfectly with your branding. This personal touch not only makes your checks more visually appealing but also showcases your attention to detail and professionalism.

Moreover, you can incorporate security features into your checks to protect against fraud and unauthorized use. This extra layer of customization not only ensures the security of your transactions but also highlights your commitment to safeguarding the interests of all parties involved.

5. Security and Fraud Prevention

Security is a top concern for businesses today, and these checks provide a secure payment method. Many check providers offer advanced security features like holograms, watermarks, and microprinting, which make it extremely difficult for counterfeiters to replicate your checks. By using secure business checks, you protect your company from potential fraud, and this not only adds to your professionalism but also presents a secure and trustworthy image to your partners and customers.

In an age where data breaches and identity theft are prevalent, the security offered by these checks is a welcome reassurance. The physical nature of checks, combined with advanced security features, helps protect your business and financial transactions from the ever-present threat of fraud.

6. Payment Flexibility

While electronic payment methods have gained popularity, it’s essential to acknowledge that not everyone prefers or accepts them. Some vendors, particularly small businesses or independent contractors may still prefer or require paper checks. By having these checks on hand, you demonstrate flexibility and the ability to accommodate your partners’ preferred payment methods.

This adaptability showcases your company’s commitment to meeting the diverse needs of your clients and suppliers, enhancing your reputation as a professional and reliable partner in the eyes of those you do business with.

7. Better Record-Keeping

Effective record-keeping is a cornerstone of professionalism. Business checks, when used for payments and transactions, provide a straightforward and organized way to maintain records. This can be invaluable for tax purposes, audits, or dispute resolution. With these checks, you can easily document every financial interaction, enhancing your image as a well-organized and professional company.

Proper record-keeping is not only important for internal purposes but can also be crucial when dealing with regulatory authorities, tax authorities, or during audits. It provides a reliable and standardized method for recording financial transactions, reducing the chances of errors and inconsistencies in your records.

8. Compliance and Legal Requirements

Many industries and regions have legal requirements for business transactions and record-keeping. It often meets these regulatory requirements, ensuring that your company is compliant with relevant laws. Adhering to legal and industry standards not only demonstrates professionalism but also safeguards your company from potential legal issues.

Compliance with legal requirements is not just a mark of professionalism; it’s a necessity for the survival and growth of your business. Utilizing these checks helps ensure that your company operates within the bounds of the law, reducing the risk of legal complications that could tarnish your professional image.

Summary

Electronic transactions have become prevalent in today’s business world, business checks continue to be a valuable tool for enhancing your company’s professional image. They offer a wide range of advantages that contribute to credibility, trust, and brand recognition. Moreover, it provides security, customization, and better record-keeping, which are key elements in maintaining a professional image. By incorporating these checks into your financial practices, you can strengthen your company’s reputation and demonstrate your commitment to professionalism in the eyes of your clients, partners, and stakeholders. So, don’t underestimate the power of the traditional business check; it’s a tool that can elevate your company’s professional image in the digital age.